气候变化研究进展 ›› 2022, Vol. 18 ›› Issue (2): 215-229.doi: 10.12006/j.issn.1673-1719.2021.198

国际气候投融资监测、报告与核证制度及启示

- 1 中国科学院科技战略咨询研究院,北京 100190

2 中国科学院大学公共政策与管理学院,北京 100049

-

收稿日期:2021-09-06修回日期:2021-11-04出版日期:2022-03-30发布日期:2022-01-06 -

通讯作者:谭显春 -

作者简介:曾桉,女,博士,zengan@casisd.cn 。 -

基金资助:国家重点研发计划(2018YFC1509008);生态环境部(20190113);生态环境部(202008);能源基金会(G-2009-32445)

International experiences on Measurement, Reporting and Verification of climate finance and implications for China

ZENG An1( ), TAN Xian-Chun1,2(

), TAN Xian-Chun1,2( ), WANG Yi1,2, GAO Jin-Xin1

), WANG Yi1,2, GAO Jin-Xin1

- 1 Institutes of Science and Development, Chinese Academy of Sciences, Beijing 100190, China

2 School of Public Policy and Management, University of Chinese Academy of Sciences, Beijing 100049, China

-

Received:2021-09-06Revised:2021-11-04Online:2022-03-30Published:2022-01-06 -

Contact:TAN Xian-Chun

摘要:

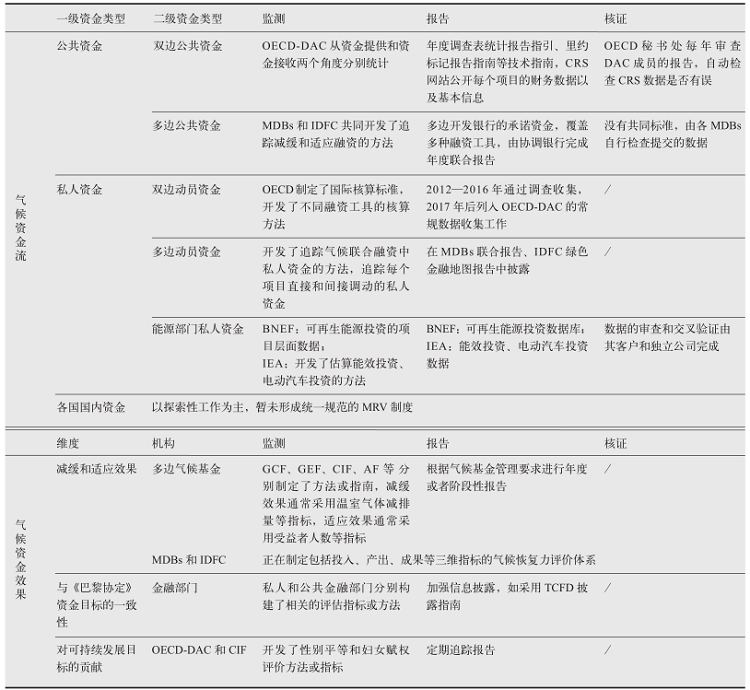

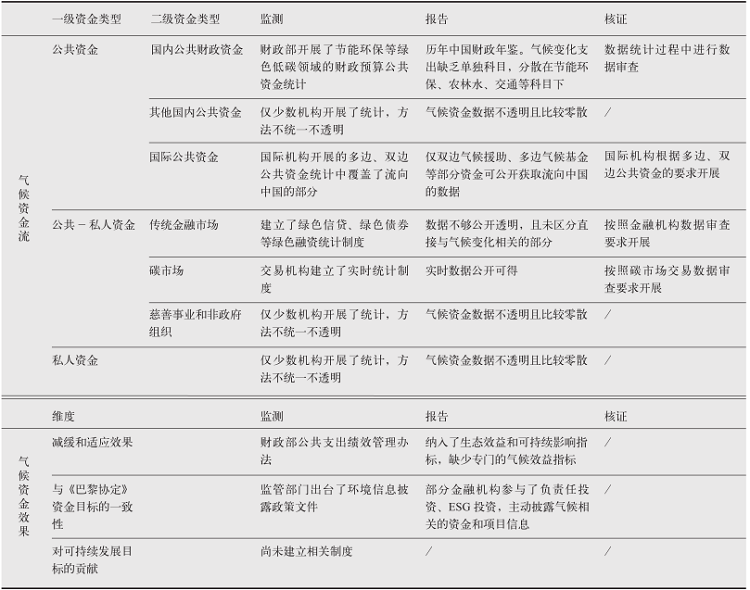

实现中国2030年前碳达峰、2060年前碳中和需要大量的资金支持,亟需构建与之匹配的气候投融资体系。气候投融资监测、报告与核证(MRV)是气候投融资体系的重要组成部分,一方面能够有效地监督报告资金来源、使用及效果,另一方面能够统筹利用现有资金充分发挥对应对气候变化的积极作用,并撬动更多资金流向气候变化领域。本文通过广泛的文献调研和专家咨询,全面总结分析国际气候投融资MRV制度进展及对我国的启示。2010年以来随着气候融资的渠道和数量不断增加,国际上建立了较为完善的双边、多边公共资金MRV制度,正在探索建立覆盖私人资金、国内资金等更多来源的气候资金MRV制度。与此同时,逐步建立了气候资金效果MRV制度,从气候资金的气候效益如减缓和适应气候变化效果,扩展到非气候效益如与《巴黎协定》资金目标的一致性、对可持续发展目标的贡献等。我国气候投融资MRV制度尚处于起步阶段,未来应从顶层设计、政策标准、统计报告、能力建设、国际合作等方面予以完善。

引用本文

曾桉, 谭显春, 王毅, 高瑾昕. 国际气候投融资监测、报告与核证制度及启示[J]. 气候变化研究进展, 2022, 18(2): 215-229.

ZENG An, TAN Xian-Chun, WANG Yi, GAO Jin-Xin. International experiences on Measurement, Reporting and Verification of climate finance and implications for China[J]. Climate Change Research, 2022, 18(2): 215-229.

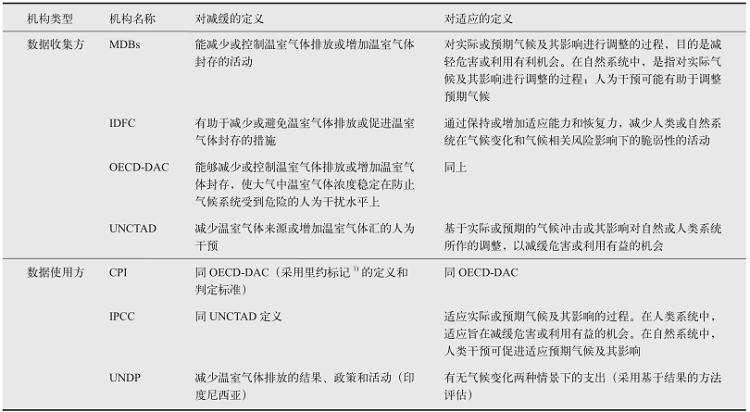

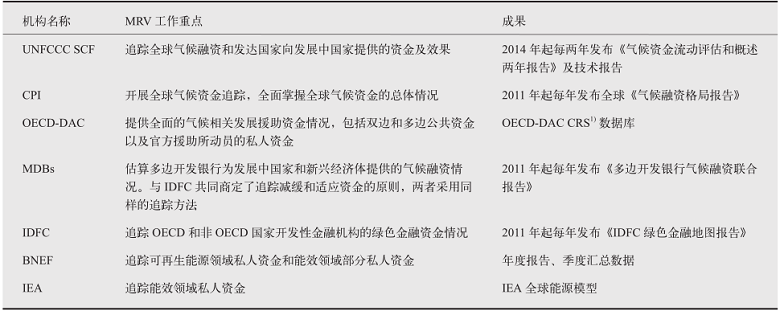

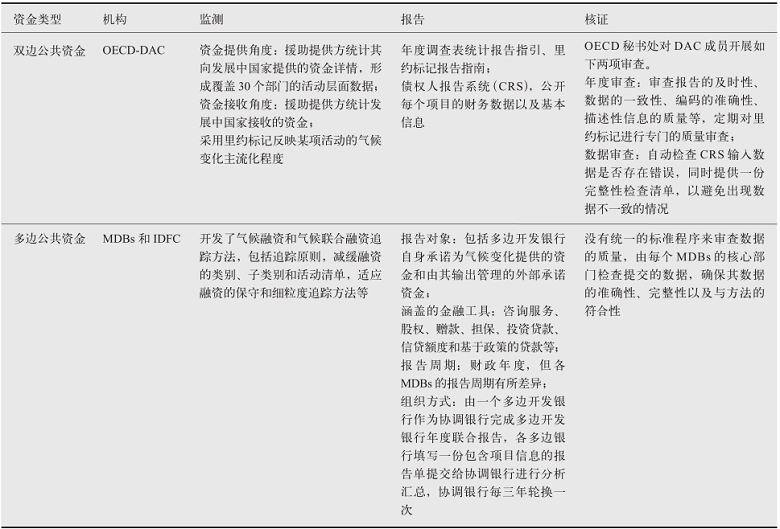

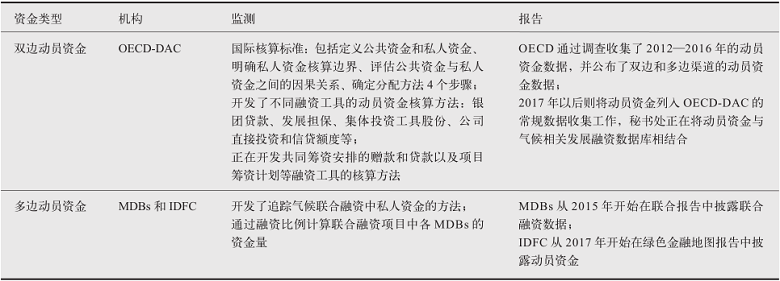

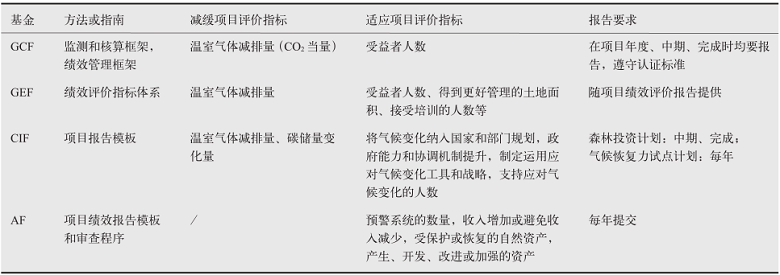

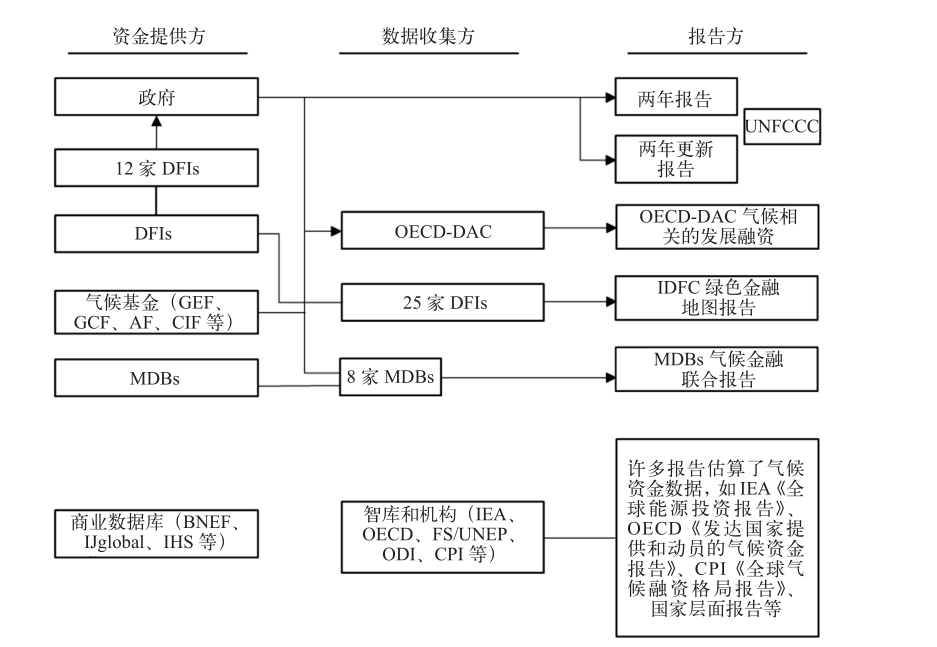

图1 国际气候投融资MRV基本情况 注:图中箭头表示正式的报告程序,例如通过UNFCCC、OECD-DAC或MDBs和IDFC的联合报告。一些DFIs向其所在国的政府报告数据,以纳入向UNFCCC或OECD-DAC的报告中。

Fig. 1 Framework of international climate finance MRV

| [1] | Energy & Climate Intelligence Unit (ECIU). Net zero tracker [EB/OL]. 2021 [2021-09-08]. https://eciu.net/netzerotracker |

| [2] | The International Renewable Energy Agency (IRENA). Global energy transformation: a road map to 2050 [EB/OL]. 2018 [2019-04-16]. https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2018/Apr/IRENA_Report_GET_2018 |

| [3] | 中国科学院可持续发展战略研究组. 2020中国可持续发展报告: 探索迈向碳中和之路 [M]. 北京: 科学出版社, 2021: 204-206. |

| Sustainable Development Strategy Research Group, Chinese Academy of Sciences. China sustainable china sustainable development report 2020: exploring pathways towards carbon neutrality [M]. Beijing: Science Press, 2021: 204-206 (in Chinese) | |

| [4] | 马骏. 以碳中和为目标完善绿色金融体系 [N/OL]. 金融时报, 2021 [2021-02-01]. https://h5.newaircloud.com/detailArticle/15048522_28236_jrsb.html?app=1&source=1. |

| Ma J. Improve the green financial system with the goal of carbon neutrality [N/OL]. Financial News, 2021 [2021-02-01]. https://h5.newaircloud.com/detailArticle/15048522_28236_jrsb.html?app=1&source=1 (in Chinese) | |

| [5] | 王灿, 张雅欣. 碳中和愿景的实现路径与政策体系[J]. 中国环境管理, 2020, 12(6):58-64. |

| Wang C, Zhang Y X. Implementation pathway and policy system of carbon neutrality vision[J]. Chinese Journal of Environment Management, 2020, 12(6):58-64 (in Chinese) | |

| [6] | European Bank for Reconstruction and Development (EBRD). Joint report on multilateral development banks' climate finance [R/OL]. 2016 [2021-09-08]. https://www.ebrd.com/home |

| [7] | Buchner B, Clark A, Falconer A,, et al. Global landscape of climate finance 2019 [R/OL]. 2019 [2021-07-06]. https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2019/ |

| [8] |

Scandurra G, Thomas A, Passaro R. Does climate finance reduce vulnerability in small island developing states? An empirical investigation[J]. Journal of Cleaner Production, 2020, 256:120330

doi: 10.1016/j.jclepro.2020.120330 URL |

| [9] | UNFCCC Standing Committee on Finance. 2018 biennial assessment and overview of climate finance flows technical report [R/OL]. 2019 [2021-08-31]. https://unfccc.int/BA-2018 |

| [10] | Organization for Economic Co-operation and Development (OECD). Climate-related development finance data [EB/OL]. 2018 [2021-04-25]. https://www.oecd.org/dac/financing-sustainable-development/development-finance-topics/Climate-related-development-finance-in-2018 |

| [11] | BloombergNEF (BNEF). BloombergNEF data download tool [EB/OL]. 2018 [2021-04-25]. https://about.bnef.com/new-energy-outlook/ |

| [12] | International Energy Agency (IEA). Energy efficiency market report 2017 [R/OL]. 2017 [2017-11-14]. https://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/energy/energy-resources/Energy_Efficiency_Marketing_Report_2017 |

| [13] | 吴昌华, 蔡含多, 任姗, 等. 中国气候融资管理体制机制研究[J]. 中国市场, 2013 (39):8-17. |

| Wu C H, Cai H D, Ren S, et al. Research on China's climate finance management system and mechanism[J]. China Market, 2013 (39):8-17 (in Chinese) | |

| [14] | 谭显春, 顾佰和, 曾桉. 国际气候投融资体系建设经验[J]. 中国金融, 2021 (12):54-55. |

| Tan X C, Gu B H, Zeng A. International experiences of climate investment and financing system[J]. China Finance, 2021 (12):54-55 (in Chinese) | |

| [15] | 姜晓群, 周泽宇, 林哲艳, 等. “后巴黎”时代气候适应国际合作进展与展望[J]. 气候变化研究进展, 2021, 17(4):484-495. |

| Jiang X Q, Zhou Z Y, Lin Z Y, et al. International cooperation on adaptation in Post-Paris times: thoughts and prospects[J]. Climate Change Research, 2021, 17(4):484-495 (in Chinese) | |

| [16] | 安岩, 顾佰和, 王毅, 等. 基于自然的解决方案: 中国应对气候变化领域的政策进展、问题与对策[J]. 气候变化研究进展, 2021, 17(2):184-194. |

| An Y, Gu B H, Wang Y, et al. Advances, problems and strategies of policy for Nature-based Solutions in the fields of climate change in China[J]. Climate Change Research, 2021, 17(2):184-194 (in Chinese) | |

| [17] | 祁悦, 柴麒敏, 刘冠英, 等. 发达国家2020年前应对气候变化行动和支持力度盘点[J]. 气候变化研究进展, 2018, 14(5):522-528. |

| Qi Y, Chai Q M, Liu G Y, et al. A stock-take on developed countries' pre-2020 climate action and support[J]. Climate Change Research, 2018, 14(5):522-528 (in Chinese) | |

| [18] | 柴麒敏, 傅莎, 温新元, 等. 中国气候投融资发展现状与政策建议[J]. 中华环境, 2019 (4):30-33. |

| Chai Q M, Fu S, Wen X Y, et al. Development status and policy suggestions of climate investment and financing in China[J]. China Environment, 2019 (4):30-33 (in Chinese) | |

| [19] | 中央财经大学气候与能源金融研究中心. 2012中国气候融资报告: 气候资金流研究 [R/OL]. 2012 [2019-08-15]. https://wenku.baidu.com/view/a068cb8a1711cc7930b71674.html. |

| Center for Climate and Energy Finance, Central University of Finance and Economics. China climate finance report 2012: a study of climate finance flows [R/OL]. 2012 [2019-08-15]. https://wenku.baidu.com/view/a068cb8a1711cc7930b71674.html (in Chinese) | |

| [20] | Choi J, Li W T. The potential for scaling climate finance in China [R/OL]. 2021 [2021-08-27]. https://www.climatepolicyinitiative.org/wp-content/uploads/2021/02/The-Potential-for-Scaling-Climate-Finance-in-China-1 |

| [21] | 许寅硕, 董子源, 王遥. 《巴黎协定》后的气候资金测量、报告和核证体系构建研究[J]. 中国人口∙资源与环境, 2016, 26(12):22-30. |

| Xu Y S, Dong Z Y, Wang Y. Establishment of a measurement, reporting and verification system of climate finance in Post-Paris Agreement[J]. China Population Resources and Environment, 2016, 26(12):22-30 (in Chinese) | |

| [22] | UNFCCC Standing Committee on Finance. 2014 biennial assessment and overview of climate finance flows report [R/OL]. 2014 [2014-08-27]. https://unfccc.int/files/cooperation_and_support/financial_mechanism/standing_committee/application/pdf/2014_biennial_assessment_and_overview_of_climate_finance_flows_report_web |

| [23] | European Bank for Reconstruction and Development (EBRD). 2018 joint report on multilateral development banks' climate finance [R/OL]. 2019 [2019-12-16]. https://publications.iadb.org/publications/english/document/2018_Joint_Report_on_Multilateral_Development_Banks_Climate_Finance_en_en |

| [24] | UNFCCC. Modalities for the accounting of financial resources provided and mobilized through public interventions in accordance with Article 9, paragraph 7, of the Paris Agreement [R/OL]. 2017 [2021-08-20]. https://unfccc.int/documents/9625 |

| [25] | Organization for Economic Co-operation and Development (OECD). DAC methodologies for measuring the amounts mobilised from the private sector by official development finance interventions [R/OL]. 2018 [2021-04-25]. https://www.oecd.org/dac/financing-sustainable-development/development-finance-standards/DAC-Methodologies-on-Mobilisation |

| [26] | Organization for Economic Co-operation and Development (OECD). Measuring mobilisation: briefing on efforts to harmonise OECD and MDB measurement methodologies [R/OL]. 2018 [2018-05-25]. https://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=DCD/DAC(2018)25&docLanguage=En |

| [27] | Organization for Economic Co-operation and Development (OECD). “Private finance for climate action: estimating the effects of effects of public interventions”, policy perspectives brochure [R/OL]. 2017 [2021-04-25]. https://www.oecd.org/env/researchcollaborative/WEB%20private-finance-for-climate-action-policy-perspectives |

| [28] | Organization for Economic Co-operation and Development (OECD). Methodologies to measure amounts mobilised from the private sector by official development finance interventions: guarantees, syndicated loans and shares in CIVs, direct investment in companies, credit lines [R/OL]. 2017 [2017-04-25]. https://www.oecd.org/dac/financing-sustainable-development/development-finance-standards/OECD-DAC-Methodologies-to-measure-amounts-mobilised-from-the-private-sector-by-official-development-finance-interventions-2016 |

| [29] | African Development Bank Group (AfDB), Asian Development Bank (ADB), European Bank for Reconstruction and Development (EBRD), et al. Private mobilisation reference guide [R/OL]. 2018 [2018-06-26]. https://documents.worldbank.org/curated/en/495061492543870701/pdf/114403-REVISED-June25-DocumentsPrivInvestMob-Draft-Ref-Guide-Master-June2018-v4 |

| [30] | The International Development Finance Club (IDFC). Green finance mapping report 2016 [R/OL]. 2017 [2019-04-17]. https://www.idfc.org/wp-content/uploads/2019/04/idfc_mapping-report-2015_2016_vf |

| [31] | Overseas Development Institute (ODI). Climate public expenditure and institutional review (CPEIR): a methodological note [R/OL]. 2012 [2014-02-23]. https://climatefinancenetwork.org/wp-content/uploads/2021/03/CPEIR_Armenia_ENG |

| [32] | International Finance Corporation (IFC). Green finance: a bottom-up approach to track existing flows [R/OL]. 2017 [2017-06-29]. https://www.cbd.int/financial/gcf/ifc-greentracking |

| [33] | Asset Owners Disclosure Project (AODP). Global climate index 2017: rating the world's investors on climate related financial risk [R/OL]. 2017 [2018-05-22]. http://aodproject.net/wp-content/uploads/2017/04/AODP-GLOBAL-INDEX-REPORT-2017_FINAL_VIEW |

| [34] | 2˚ Investing Initiative, World Resources Institute, UNEP Finance Initiative. Climate strategies and metrics: exploring options for institutional investors [R/OL]. 2015 [2021-08-21]. https://www.greenfinanceplatform.org/research/climate-strategies-and-metrics-exploring-options-institutional-investors |

| [35] | 2˚ Investing Initiative. Assessing the alignment of portfolios with climate goals [R/OL]. 2015 [2021-08-21]. https://2degrees-investing.org/wp-content/uploads/2018/02/2dportfolio_v0_small |

| [36] | Höhne N, Bals C, Röser F,, et al. Developing criteria to align investments with 2℃ compatible pathways [R/OL]. 2015 [2021-07-02]. https://germanwatch.org/en/10744 |

| [37] | The Institute for Climate Economics (I4CE). 2017 climate mainstreaming practices report [R/OL]. 2017 [2021-02-23]. https://www.greengrowthknowledge.org/research/2017-climate-mainstreaming-practices-report |

| [38] | Agence Française de Développement (AFD). Sustainable development analysis [R/OL]. 2018 [2021-03-17]. https://unfccc.int/sites/default/files/resource/sustainable-development-analysis%20%281%29 |

| [39] | The World Bank (WB), Ecofys and Vivid Economics. State and trends of carbon pricing 2017 [R/OL]. 2017 [2021-04-23]. https://openknowledge.worldbank.org/bitstream/handle/10986/28510/wb_report_171027.pdf?sequence=5&isAllowed=y |

| [40] | Climate Transparency. Financing the transition from brown to green: how to track country performance towards low carbon, climate-resilient economies [R/OL]. 2017 [2017-12-12]. http://www.climate-transparency.org/wp-content/uploads/2017/12/Financing_the_transition |

| [41] | Task Force on Climate-related Financial Disclosures (TCFD). Final report: recommendations of the task force on climate-related financial disclosures [R/OL]. 2017 [2021-10-02]. https://assets.bbhub.io/company/sites/60/2020/10/FINAL-2017-TCFD-Report-11052018 |

| [42] | Organization for Economic Co-operation and Development (OECD). Handbook on the OECD-DAC gender equality policy marker [R/OL]. 2016 [2016-12-20]. https://www.oecd.org/dac/gender-development/Handbook-OECD-DAC-Gender-Equality-Policy-Marker |

| [43] | 生态环境部, 国家发改委, 人民银行, 等. 关于促进应对气候变化投融资的指导意见 [EB/OL]. 2020 [2020-10-26]. http://www.mee.gov.cn/xxgk2018/xxgk/xxgk03/202010/t20201026_804792.html. |

| Ministry of Ecology and Environment, National Development and Reform Commission, People's Bank of China, et al. Guidelines on promoting investment and financing for addressing climate change [EB/OL]. 2020 [2020-10-26]. http://www.mee.gov.cn/xxgk2018/xxgk/xxgk03/202010/t20201026_804792.html (in Chinese) |

| [1] | 张浩楠, 申融容, 张兴平, 康俊杰, 袁家海. 中国碳中和目标内涵与实现路径综述[J]. 气候变化研究进展, 2022, 18(2): 240-252. |

| [2] | 任佳雪, 高庆先, 陈海涛, 孟丹, 张阳, 马占云, 刘倩, 唐甲洁. 碳中和愿景下的污水处理厂温室气体排放情景模拟研究[J]. 气候变化研究进展, 2021, 17(4): 410-419. |

| [3] | 姜克隽, 冯升波. 走向《巴黎协定》温升目标:已经在路上[J]. 气候变化研究进展, 2021, 17(1): 1-6. |

| [4] | 张雅欣, 罗荟霖, 王灿. 碳中和行动的国际趋势分析[J]. 气候变化研究进展, 2021, 17(1): 88-97. |

| [5] | 洪祎君, 崔惠娟, 王芳, 葛全胜. 基于发展中国家自主贡献文件的资金需求评估[J]. 气候变化研究进展, 2018, 14(6): 621-631. |

| [6] | 祁悦,柴麒敏,刘冠英,樊星,钟洋,马爱民. 发达国家2020年前应对气候变化行动和支持力度盘点[J]. 气候变化研究进展, 2018, 14(5): 522-528. |

| 阅读次数 | ||||||

|

全文 |

|

|||||

|

摘要 |

|

|||||