气候变化研究进展 ›› 2023, Vol. 19 ›› Issue (4): 483-495.doi: 10.12006/j.issn.1673-1719.2022.260

基于实物期权法的航空公司减排投资策略研究

- 1 中国民航大学交通科学与工程学院,天津 300300

2 中国民航环境与可持续发展研究中心,天津 300300

3 中国民航管理干部学院,北京 100102

-

收稿日期:2022-11-14修回日期:2023-02-01出版日期:2023-07-30发布日期:2023-06-30 -

通讯作者:王超彬,男,硕士研究生,wcb_0701@163.com -

作者简介:陈俣秀,女,副教授,yuxiuchen1@163.com -

基金资助:国家社会科学基金项目“碳中和目标下中国民航‘三链’协同脱碳研究”(22BJY020);中国民用航空局安全能力建设项目“ICAO国际航空碳抵消及减排机制(CORSIA)一揽子标准修订及碳减排长期目标政策的研究”(14002500000020J074)

Research on the investment strategy of airline emission reduction based on real option method

CHEN Yu-Xiu1,2( ), WANG Chao-Bin1(

), WANG Chao-Bin1( ), YU Jian3

), YU Jian3

- 1 College of Transportation Science and Engineering, Civil Aviation University of China, Tianjin 300300, China

2 Research Center for Environment and Sustainable Development of the China Civil Aviation, Tianjin 300300, China

3 Civil Aviation Management Institute of China, Beijing 100102, China

-

Received:2022-11-14Revised:2023-02-01Online:2023-07-30Published:2023-06-30

摘要:

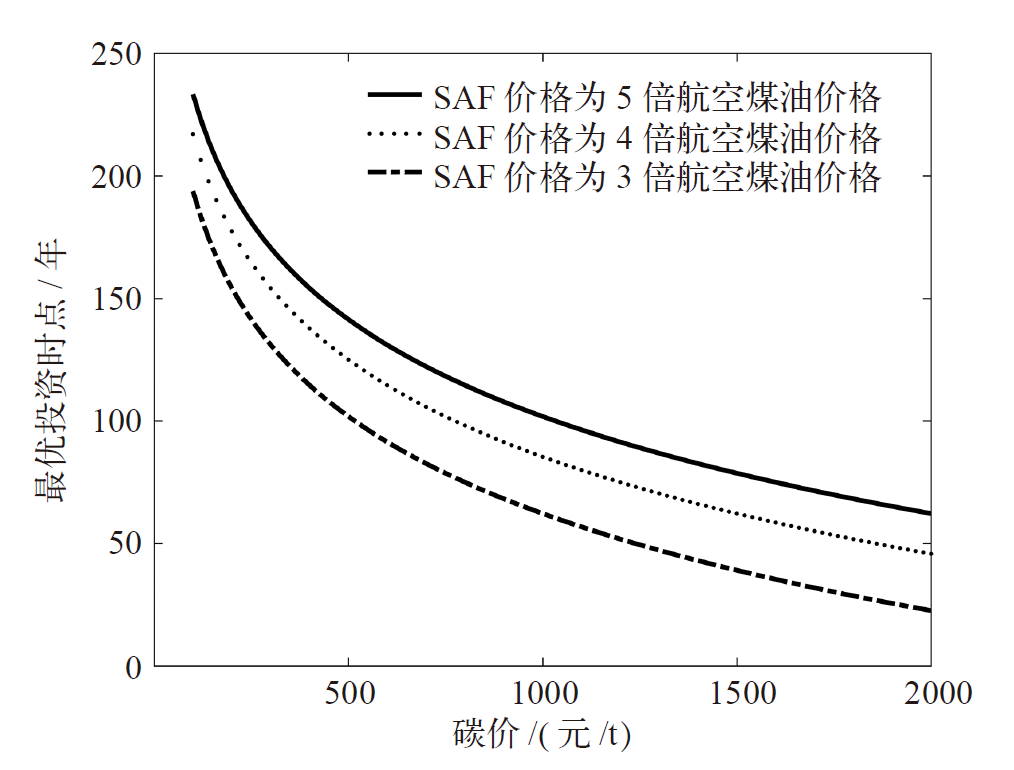

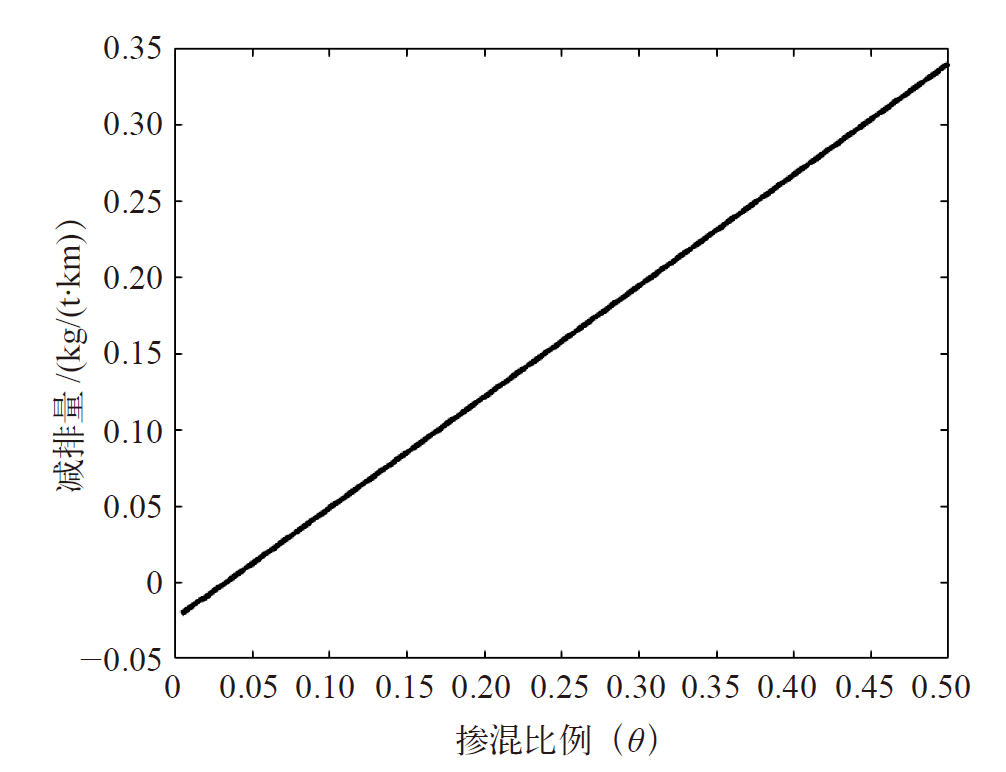

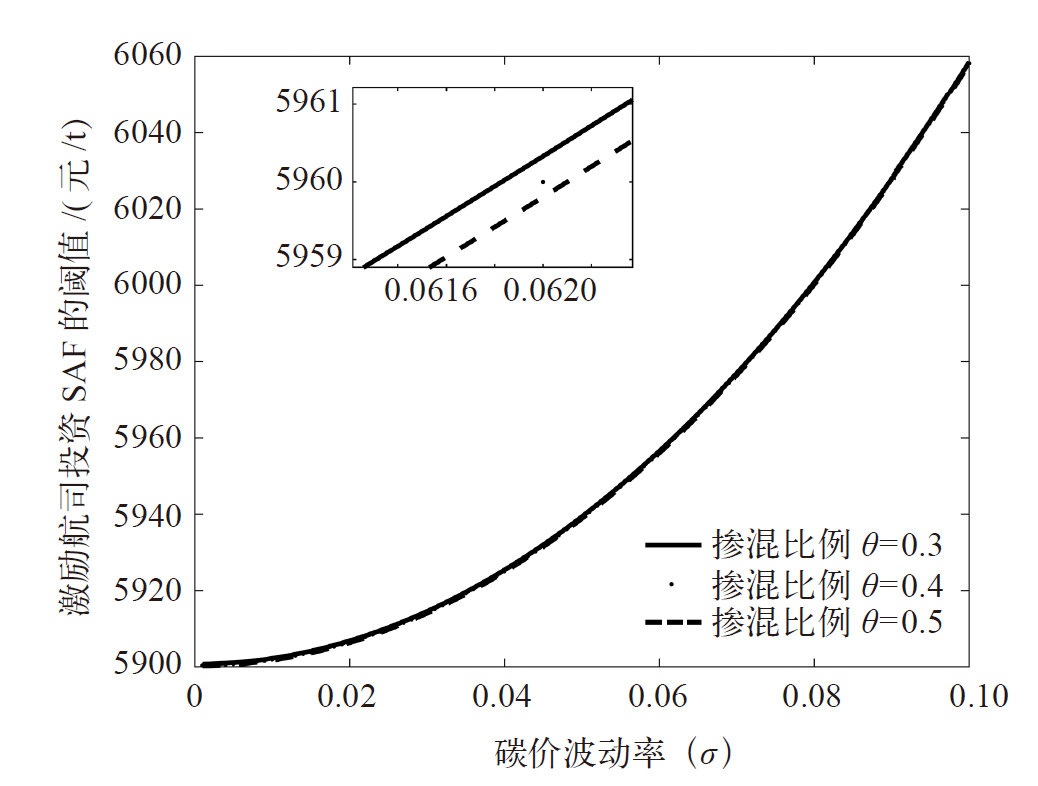

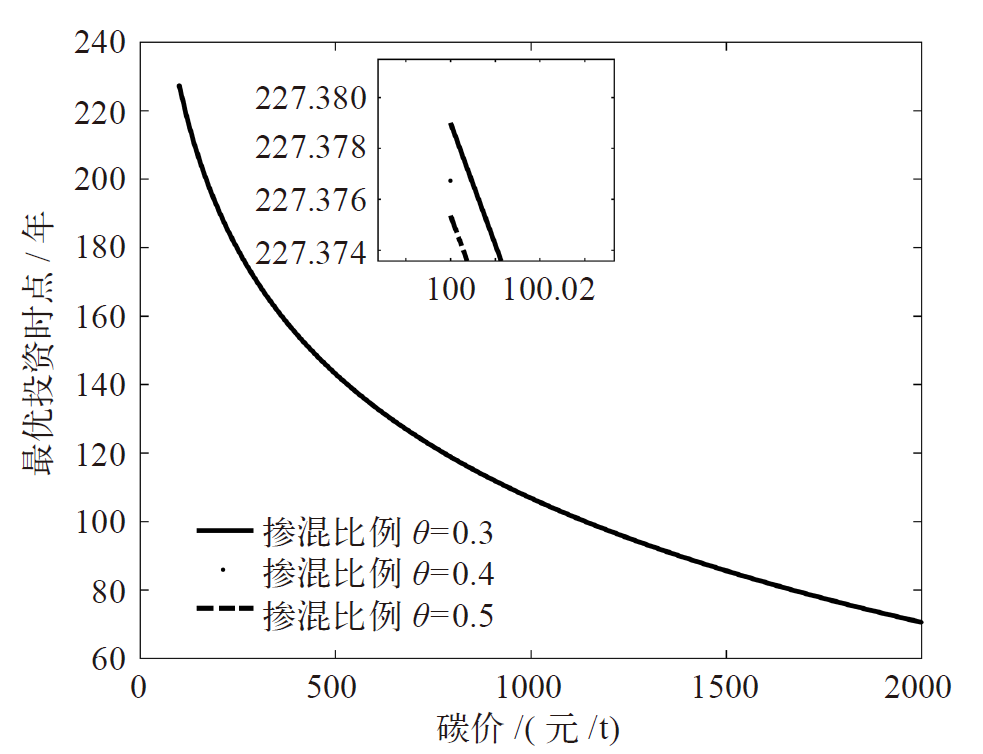

民航绿色发展是推进中国民航高质量发展的内在要求,是提高我国民航业供给竞争力的重要体现之一。中国民航市场需求潜力巨大,随着市场的恢复,能源消费和二氧化碳排放将刚性增长。在民航业关注的减排技术或措施中,与飞机及发动机技术改进、航班地面与空中运行水平提升以及市场机制等减排措施相比,可持续航空燃油的使用减排潜力巨大,但投资及成本高昂。文章从航空公司的角度出发,采用实物期权方法构建了减排投资价值模型,重点讨论了可持续航空燃油投资策略,包括投资阈值、投资时点、掺混比例、最优投资条件等,分析市场机制、燃油成本等不确定性因素对航空公司减排投资行为的影响,并提出航空公司开展减排投资时需要重点关注的碳排放约束下激励投资的条件以及使用何种掺混比例等问题,为航空公司减排策略、政府相关政策的制定提供一定参考。

引用本文

陈俣秀, 王超彬, 于剑. 基于实物期权法的航空公司减排投资策略研究[J]. 气候变化研究进展, 2023, 19(4): 483-495.

CHEN Yu-Xiu, WANG Chao-Bin, YU Jian. Research on the investment strategy of airline emission reduction based on real option method[J]. Climate Change Research, 2023, 19(4): 483-495.

| [1] | IPCC. Climate change 2021: the physical science basis[M]. Cambridge: Cambridge University Press, 2021 |

| [2] | 王庆一. 2021能源数据[M]. 北京: 绿色创新发展中心, 2022. |

| Wang Q Y. Energy statistics 2021[M]. Beijing: Innovative Green Development Program, 2022 (in Chinese) | |

| [3] | 袁志逸, 李振宇, 康利平, 等. 中国交通部门低碳排放措施和路径研究综述[J]. 气候变化研究进展, 2021, 17 (1): 27-35. |

| Yuan Z Y, Li Z Y, Kang L P, et al. A review of low-carbon measurements and transition pathway of transport sector in China[J]. Climate Change Research, 2021, 17 (1): 27-35 (in Chinese) | |

| [4] | 民航局. “十四五”民航绿色发展专项规划[R/OL]. 2022 [2022-10-22]. http://www.caac.gov.cn/XXGK/XXGK/FZGH/202201/t20220127_211345.html. |

| Civil Aviation Administration of China. 14th five-year special plan for green development of China’s civil aviation[R/OL]. 2022 [2022-10-22]. http://www.caac.gov.cn/XXGK/XXGK/FZGH/202201/t20220127_211345.html (in Chinese) | |

| [5] | 张希良, 张达, 余润心. 中国特色全国碳市场设计理论与实践[J]. 管理世界, 2021, 37 (8): 80-95. |

| Zhang X L, Zhang D, Yu R X. Theory and practice of China’s national carbon emissions trading system[J]. Journal of Management World, 2021, 37 (8): 80-95 (in Chinese) | |

| [6] | IPCC. Climate change 2022: mitigation of climate change[M]. Cambridge: Cambridge University Press, 2022 |

| [7] | NLR Royal Netherlands Aerospace Centre, S A E. Destination 2050: a route to net zero European aviation[R/OL]. 2021[2022-10-22]. https://www.destination2050.eu/wp-content/uploads/2021/03/Destination2050_Report.pdf |

| [8] | Federal Aviation Administration. United States 2021 aviation climate action plan[R]. Washington DC: Federal Aviation Administration, 2021 |

| [9] | International Civil Aviation Organization ICAO Secretariat. Overview of climate goals and ICAO’s work on a long-term aspirational goal for international aviation (LTAG)[R]. Montreal: ICAO, 2022 |

| [10] |

Liu X, Hang Y, Wang Q W, et al. Flying into the future: a scenario-based analysis of carbon emissions from China’s civil aviation[J]. Journal of Air Transport Management, 2020, 85: 101793

doi: 10.1016/j.jairtraman.2020.101793 URL |

| [11] | 刘笑. 中国民航部门碳排放驱动因素及减排路径研究[D]. 南京: 南京航空航天大学, 2018. |

| Liu X. Study on the driving factors of carbon emission and the path of emission reduction in the civil aviation department of China[D]. Nanjing: Nanjing University of Aeronautics and Astronautics, 2018 (in Chinese) | |

| [12] | 石钰婷. 航空运输碳排放演变特征及驱动因素研究[D]. 南京: 南京航空航天大学, 2020. |

| Shi Y T. Research on evolution characteristics and driving factor of air transport industry[D]. Nanjing: Nanjing University of Aeronautics and Astronautics, 2020 (in Chinese) | |

| [13] | 赵凤彩, 尹力刚, 高兰. 国际航空碳排放权分配公平性研究[J]. 气候变化研究进展, 2014, 10 (6): 445-452. |

| Zhao F C, Yin L G, Gao L. International aviation carbon emission rights fair allocation[J]. Climate Change Research, 2014, 10 (6): 445-452 (in Chinese) | |

| [14] | 颜佳. 碳交易对我国民航客运市场的影响及对策研究[D]. 天津: 中国民航大学, 2018. |

| Yan J. A study on the impact of carbon trading on domestic air passenger transport market and countermeasures[D]. Tianjin:Civil Aviation University of China, 2018 (in Chinese) | |

| [15] | 廖维君, 范英. 国际航空碳抵消协议对不同国家的影响分析[J]. 中国人口?资源与环境, 2020, 30 (6): 10-19. |

| Liao W J, Fan Y. Analysis of the impact of carbon offsetting and reduction scheme for international aviation on different countries[J]. China Population, Resources and Environment, 2020, 30 (6): 10-19 (in Chinese) | |

| [16] | 朱冰. 基于CGE模型的我国民航碳税政策研究[D]. 南京: 南京航空航天大学, 2020. |

| Zhu B. Strategic analysis of carbon tax policies in civil aviation in China using CGE model[D]. Nanjing: Nanjing University of Aeronautics and Astronautics, 2020 (in Chinese) | |

| [17] |

Yu K M, Strauss J, Liu S L, et al. Effects of railway speed on aviation demand and CO2 emissions in China[J]. Transportation Research Part D: Transport and Environment, 2021, 94: 102772

doi: 10.1016/j.trd.2021.102772 URL |

| [18] | 许绩辉, 王克. 中国民航业中长期碳排放预测与技术减排潜力分析[J]. 中国环境科学, 2022, 42 (7): 3412-3424. |

| Xu J H, Wang K. Medium- and long-term carbon emission forecast and technological emission reduction potential analysis of China’s civil aviation industry[J]. China Environmental Science, 2022, 42 (7): 3412-3424 (in Chinese) | |

| [19] | 王明喜, 鲍勤, 汤铃, 等. 碳排放约束下的企业最优减排投资行为[J]. 管理科学学报, 2015, 18 (6): 41-57. |

| Wang M X, Bao Q, Tang L, et al. Enterprises’ optimal abatement investment behavior with the carbon emission constraint[J]. Journal of Management Sciences in China, 2015, 18 (6): 41-57 (in Chinese) | |

| [20] | 谭建, 闫丽娜, 李萌. 单位与总量两种碳限额机制下的企业最优决策[J]. 系统科学学报, 2021 (4): 68-71. |

| Tan J, Yan L N, Li M. Optimal decision-making of enterprises under two carbon quota mechanisms: unit and total[J]. Chinese Journal of Systems Science, 2021 (4): 68-71, 76 (in Chinese) | |

| [21] |

Yang W, Pan Y C, Ma J H, et al. Effects of allowance allocation rules on green technology investment and product pricing under the cap-and-trade mechanism[J]. Energy Policy, 2020, 139: 111333

doi: 10.1016/j.enpol.2020.111333 URL |

| [22] |

Chen W, Chen J, Ma Y K. Renewable energy investment and carbon emissions under cap-and-trade mechanisms[J]. Journal of Cleaner Production, 2021, 278: 123341

doi: 10.1016/j.jclepro.2020.123341 URL |

| [23] | 黄帝, 陈剑, 周泓. 配额-交易机制下动态批量生产和减排投资策略研究[J]. 中国管理科学, 2016, 24 (4): 129-137. |

| Huang D, Chen J, Zhou H. Optimal production and emissions reduction investment policies in a dynamic Lot Sizing model under cap-and-trade[J]. Chinese Journal of Management Science, 2016, 24 (4): 129-137 (in Chinese) | |

| [24] |

Islegen O, Reichelstein S. Carbon capture by fossil fuel power plants: an economic analysis[J]. Management Science, 2011, 57 (1): 21-39

doi: 10.1287/mnsc.1100.1268 URL |

| [25] |

Abadie L M, Chamorro J M. European CO2 prices and carbon capture investments[J]. Energy Economics, 2008, 30 (6): 2992-3015

doi: 10.1016/j.eneco.2008.03.008 URL |

| [26] | 王素凤, 杨善林, 彭张林. 面向多重不确定性的发电商碳减排投资研究[J]. 管理科学学报, 2016, 19 (2): 31-41. |

| Wang S F, Yang S L, Peng Z L. Research on the power producer’s carbon abatement investment in view of multiple uncertainties[J]. Journal of Management Sciences in China, 2016, 19 (2): 31-41 (in Chinese) | |

| [27] | 张新华, 黄天铭, 甘冬梅, 等. 考虑碳价下限的燃煤发电碳减排投资及其政策分析[J]. 中国管理科学, 2020, 28 (11): 167-174. |

| Zhang X H, Huang T M, Gan D M, et al. Carbon emission reduction investment for coal-fired power plants and policy analysis considering carbon price floor[J]. Chinese Journal of Management Science, 2020, 28 (11): 167-174 (in Chinese) | |

| [28] |

Zhou W J, Zhu B, Fuss S, et al. Uncertainty modeling of CCS investment strategy in China’s power sector[J]. Applied Energy, 2010, 87 (7): 2392-2400

doi: 10.1016/j.apenergy.2010.01.013 URL |

| [29] | Yang M, Blyth W J. Modeling investment risks and uncertainties with real options approach[R]. Paris: International Energy Agency (IEA), 2007 |

| [30] | 王钰, 李喜华. 基于实物期权的政府投资生态补偿项目最优策略研究[J]. 系统科学与数学, 2021, 41 (10): 2776-2799. |

|

Wang Y, Li X H. Research on the optimal strategy of government investment in ecological compensation projects based on real options[J]. Journal of Systems Science and Mathematical Sciences, 2021, 41 (10): 2776-2799 (in Chinese)

doi: 10.12341/jssms21153 |

|

| [31] |

Huang C, Chen L F, Tadikamalla P R, et al. Valuation and investment strategies of carbon capture and storage technology under uncertainties in technology, policy and market[J]. The Journal of the Operational Research Society, 2021, 72 (2): 292-303

doi: 10.1080/01605682.2019.1678402 URL |

| [32] |

D Amore F, Lovisotto L, Bezzo F. Introducing social acceptance into the design of CCS supply chains: a case study at a European level[J]. Journal of Cleaner Production, 2020, 249: 119337

doi: 10.1016/j.jclepro.2019.119337 URL |

| [33] |

Agaton C B. Application of real options in carbon capture and storage literature: valuation techniques and research hotspots[J]. Science of The Total Environment, 2021, 795: 148683

doi: 10.1016/j.scitotenv.2021.148683 URL |

| [34] | Dixit A K, Pindyck R S. Investment under uncertainty[M]. New Jersey: Princeton University Press, 1994 |

| [35] |

Zhang M M, Zhou D Q, Zhou P, et al. Optimal design of subsidy to stimulate renewable energy investments: the case of China[J]. Renewable and Sustainable Energy Reviews, 2017, 71: 873-883

doi: 10.1016/j.rser.2016.12.115 URL |

| [36] | 甘冬梅. 考虑碳价限制的燃煤发电商碳减排投资决策研究[D]. 长沙: 长沙理工大学, 2020. |

| Gan D M. Carbon emission reduction investment strategy for coal-fired power plants considering carbon price limit[D]. Changsha: Changsha University of Science and Technology, 2020 (in Chinese) | |

| [37] | 凤振华. 碳市场复杂系统价格波动机制与风险管理研究[D]. 合肥: 中国科学技术大学, 2012. |

| Feng Z H. Price volatility and risk management models for carbon market complex system[D]. Hefei: University of Science and Technology of China, 2012 (in Chinese) | |

| [38] | 中国民用航空局发展计划司. 中国民航统计年鉴—2011[M]. 北京: 中国民航出版社, 2011. |

| CAAC Department of Development Planning. Statistical yearbook on civil aviation of China-2011[M]. Beijing: China Civil Aviation Publishing House, 2011 (in Chinese) | |

| [39] | 中国民用航空局发展计划司. 中国民航统计年鉴—2012[M]. 北京: 中国民航出版社, 2012. |

| CAAC Department of Development Planning. Statistical yearbook on civil aviation of China-2012[M]. Beijing: China Civil Aviation Publishing House, 2012 (in Chinese) | |

| [40] | 中国民用航空局发展计划司. 中国民航统计年鉴—2013[M]. 北京: 中国民航出版社, 2013. |

| CAAC Department of Development Planning. Statistical yearbook on civil aviation of China-2013[M]. Beijing: China Civil Aviation Publishing House, 2013 (in Chinese) | |

| [41] | 中国民用航空局发展计划司. 中国民航统计年鉴—2014[M]. 北京: 中国民航出版社, 2014. |

| CAAC Department of Development Planning. Statistical yearbook on civil aviation of China-2014[M]. Beijing: China Civil Aviation Publishing House, 2014 (in Chinese) | |

| [42] | 中国民用航空局发展计划司. 中国民航统计年鉴—2015[M]. 北京: 中国民航出版社, 2015. |

| CAAC Department of Development Planning. Statistical yearbook on civil aviation of China-2015[M]. Beijing: China Civil Aviation Publishing House, 2015 (in Chinese) | |

| [43] | 中国民用航空局发展计划司. 中国民航统计年鉴—2016[M]. 北京: 中国民航出版社, 2016. |

| CAAC Department of Development Planning. Statistical yearbook on civil aviation of China-2016[M]. Beijing: China Civil Aviation Publishing House, 2016 (in Chinese) | |

| [44] | 中国民用航空局发展计划司. 中国民航统计年鉴—2017[M]. 北京: 中国民航出版社, 2017. |

| CAAC Department of Development Planning. Statistical yearbook on civil aviation of China-2017[M]. Beijing: China Civil Aviation Publishing House, 2017 (in Chinese) | |

| [45] | 中国民用航空局发展计划司. 中国民航统计年鉴—2018[M]. 北京: 中国民航出版社, 2018. |

| CAAC Department of Development Planning. Statistical yearbook on civil aviation of China-2018[M]. Beijing: China Civil Aviation Publishing House, 2018 (in Chinese) | |

| [46] | 中国民用航空局发展计划司. 中国民航统计年鉴—2019[M]. 北京: 中国民航出版社, 2019. |

| CAAC Department of Development Planning. Statistical yearbook on civil aviation of China-2019[M]. Beijing: China Civil Aviation Publishing House, 2019 (in Chinese) | |

| [47] | 中国民用航空局发展计划司. 中国民航统计年鉴—2020[M]. 北京: 中国民航出版社, 2021. |

| CAAC Department of Development Planning. Statistical yearbook on civil aviation of China-2020[M]. Beijing: China Civil Aviation Publishing House, 2021 (in Chinese) | |

| [48] |

Murto P. Timing of investment under technological and revenue-related uncertainties[J]. Journal of Economic Dynamics and Control, 2007, 31 (5): 1473-1497

doi: 10.1016/j.jedc.2006.05.010 URL |

| [49] | Burtraw D, Fraas A, Richardson N. Tradable standards for Clean Air Act carbon policy[J]. Environmental Law Reporter, 2012, 42 (4): 10338 |

| [50] | Pizer W A, Zhang X L. China’s new national carbon market[J]. American Economic Association Papers and Proceedings, 2018, 108: 463-467 |

| [51] | 李庆, 赵新泉, 葛翔宇. 政策不确定性对可再生能源电力投资影响研究: 基于实物期权理论证明与分析[J]. 中国管理科学, 2015, 23 (S1): 445-452. |

| Li Q, Zhao X Q, Ge X Y. Study of real option decisions under the effects of policy uncertainty on investment of renewable energy electricity[J]. Chinese Journal of Management Science, 2015, 23 (S1): 445-452 (in Chinese) | |

| [52] | 张新华, 叶泽, 李薇. 价格与技术不确定条件下的发电商碳捕获投资模型及分析[J]. 管理工程学报, 2012, 26 (3): 109-113. |

| Zhang X H, Ye Z, Li W. The power producer’s carbon capture investment model and its analysis under price and technology uncertainties[J]. Journal of Industrial Engineering and Engineering Management, 2012, 26 (3): 109-113 (in Chinese) | |

| [53] |

Zhang M M, Zhou P, Zhou D Q. A real options model for renewable energy investment with application tosolar photovoltaic power generation in China[J]. Energy Economics, 2016, 59: 213-226

doi: 10.1016/j.eneco.2016.07.028 URL |

| [54] | Slater H, De Boer D, 钱国强, 等. 2021年中国碳价调查报告[R]. 北京: Inner City Fund (ICF), 2021. |

| Slater H, De Boer D, Qian G Q, et al. China’s carbon price survey report in 2021[R]. Beijing: ICF, 2021 (in Chinese) | |

| [55] |

Abrantes I, Ferreira A F, Silva A, et al. Sustainable aviation fuels and imminent technologies: CO2 emissions evolution towards 2050[J]. Journal of Cleaner Production, 2021, 313: 127937

doi: 10.1016/j.jclepro.2021.127937 URL |

| [56] |

Tanzil A H, Brandt K, Wolcott M, et al. Strategic assessment of sustainable aviation fuel production technologies: yield improvement and cost reduction opportunities[J]. Biomass and Bioenergy, 2021, 145: 105942

doi: 10.1016/j.biombioe.2020.105942 URL |

| No related articles found! |

| 阅读次数 | ||||||

|

全文 |

|

|||||

|

摘要 |

|

|||||