Climate Change Research ›› 2023, Vol. 19 ›› Issue (2): 227-237.doi: 10.12006/j.issn.1673-1719.2022.156

• Greenhouse Gas Emissions • Previous Articles Next Articles

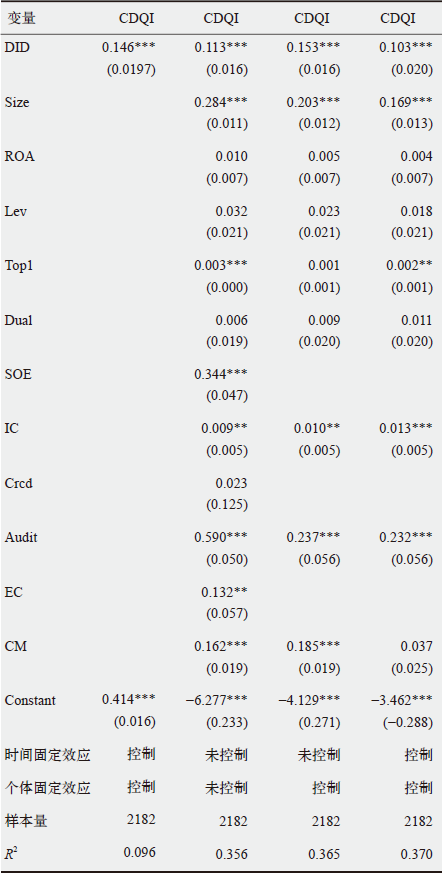

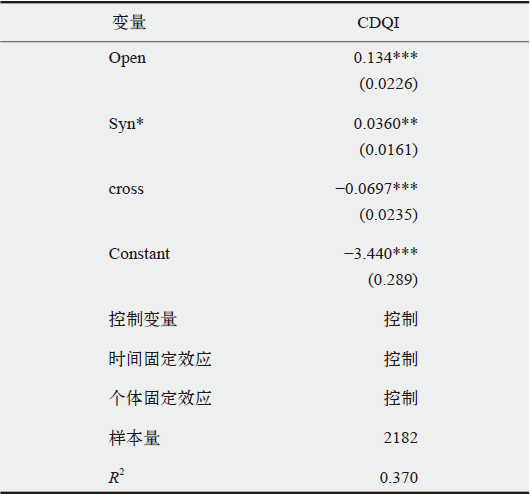

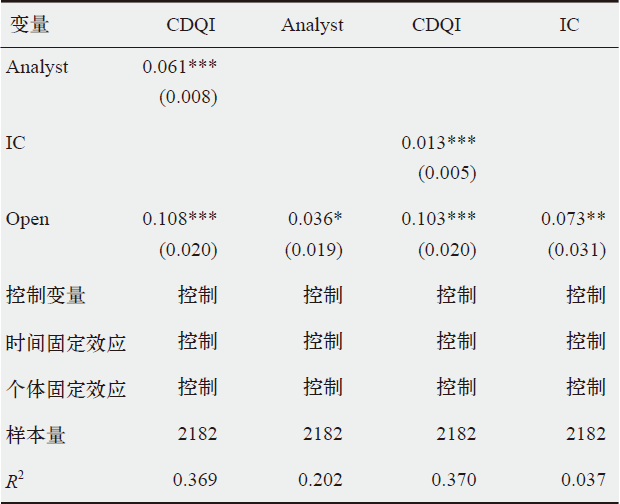

Carbon information disclosure and capital market opening—a practical test based on Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect

- School of Environment and Natural Resources, Renmin University of China, Beijing 100872, China

-

Received:2022-06-28Revised:2022-11-05Online:2023-03-30Published:2022-12-09

Cite this article

XU Guang-Qing, WU Jing-Yi. Carbon information disclosure and capital market opening—a practical test based on Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect[J]. Climate Change Research, 2023, 19(2): 227-237.

share this article

Add to citation manager EndNote|Ris|BibTeX

URL: http://www.climatechange.cn/EN/10.12006/j.issn.1673-1719.2022.156

| [1] | 张宁, 庞军. 全国碳市场引入CCER交易及抵销机制的经济影响研究[J]. 气候变化研究进展, 2022, 18 (5): 622-636. |

| Zhang N, Pang J. The economic impacts of introducing CCER trading and offset mechanism into the national carbon market of China[J]. Climate Change Research, 2022, 18 (5): 622-636 (in Chinese) | |

| [2] | 谭德明, 邹树梁. 碳信息披露国际发展现状及我国碳信息披露框架的构建[J]. 统计与决策, 2010 (11): 126-128. |

| Tan D M, Zou S L. The international development status of carbon information disclosure and the construction of China’s carbon information disclosure framework[J]. Statistics & Decision, 2010 (11): 126-128 (in Chinese) | |

| [3] |

He Y, Tang Q, Wang K. Carbon disclosure, carbon performance, and cost of capital[J]. China Journal of Accounting Studies, 2013, 1 (3): 190-220

doi: 10.1080/21697221.2014.855976 URL |

| [4] | 蒋琰. 碳信息披露研究[M]. 南京: 南京大学出版社, 2017. |

| Jiang Y. Research on carbon disclosure[M]. Nanjing: Nanjing University Press, 2017 (in Chinese) | |

| [5] | Luo L, Lan Y C, Tang Q L. Corporate incentives to disclose carbon information: evidence from the CDP global 500 report[J]. Journal of International Financial Management & Accounting, 2012, 23 (2): 93-120 |

| [6] |

Tang Q, Luo L. Transparency of corporate carbon disclosure: international evidence[J]. Ssrn Electronic Journal, 2011. DOI: 10.2139/ssrn.1885230

doi: 10.2139/ssrn.1885230 |

| [7] | 陈华, 王海燕, 陈智. 公司特征与碳信息自愿性披露: 基于合法性理论的分析视角[J]. 会计与经济研究, 2013, 27 (4): 30-42. |

| Chen H, Wang H Y, Chen Z. Corporate characteristics and voluntary carbon disclosure: a perspective of legitimacy theory[J]. Accounting and Economics Research, 2013, 27 (4): 30-42 (in Chinese) | |

| [8] | 闫海洲, 陈百助. 气候变化、环境规制与公司碳排放信息披露的价值[J]. 金融研究, 2017 (6): 142-158. |

| Yan H Z, Chen B Z. Climate change, environment regulation and the firm value of carbon emissions disclosure[J]. Journal of Financial Research, 2017 (6): 142-158 (in Chinese) | |

| [9] | 董淑兰, 邹安妮, 刘芮萌. 社会信任、碳信息披露与企业绩效的关系研究: 基于中国城市商业信用CEI指数[J]. 会计之友, 2018 (21): 73-78. |

| Dong S L, Zou A N, Liu R M. Research on the relationship between social trust, carbon information disclosure and enterprise performance[J]. Friends of Accounting, 2018 (21): 73-78 (in Chinese) | |

| [10] | 宫宁, 段茂盛. 企业碳信息披露的动机与影响因素: 基于上证社会责任指数成分股企业的分析[J]. 环境经济研究, 2021, 6 (1): 31-52. |

| Gong N, Duan M S. The motivation and influencing factors of corporate carbon information disclosure: an analysis of the constituent enterprises of SSE social responsibility index[J]. Journal of Environmental Economics, 2021, 6 (1): 31-52 (in Chinese) | |

| [11] | 王朕. 企业自愿性碳信息披露机理与因素研究[J]. 商业会计, 2021 (15): 43-47. |

| Wang Z. Research on the mechanism and factors of voluntary carbon information disclosure in enterprises[J]. Commercial Accounting, 2021 (15): 43-47 (in Chinese) | |

| [12] | 李力, 刘全齐, 唐登莉. 碳绩效、碳信息披露质量与股权融资成本[J]. 管理评论, 2019, 31 (1): 221-235. |

| Li L, Liu Q Q, Tang D L. Carbon performance, carbon information disclosure quality and cost of equity financing[J]. Management Review, 2019, 31 (1): 221-235 (in Chinese) | |

| [13] | 崔秀梅, 李心合, 唐勇军. 社会压力、碳信息披露透明度与权益资本成本[J]. 当代财经, 2016 (11): 117-129. |

| Cui X M, Li X H, Tang Y J. Social pressure, transparency of carbon information disclosure and cost of equity capital[J]. Contemporary Finance & Economics, 2016 (11): 117-129 (in Chinese) | |

| [14] | 陈华, 刘婷, 张艳秋. 公司特征、内部治理与碳信息自愿性披露: 基于合法性理论的分析视角[J]. 生态经济, 2016, 32 (9): 52-58. |

| Chen H, Liu T, Zhang Y Q. Corporate characteristics, internal governance and carbon information voluntary disclosure: from the perspective of legitimacy theory[J]. Ecological Economy, 2016, 32 (9): 52-58 (in Chinese) | |

| [15] | 谈多娇, 王丹, 周家齐. 碳市场、内部控制和碳信息质量: 基于中国A股电力企业的实证研究[J]. 会计之友, 2022 (2): 65-69. |

| Tan D J, Wang D, Zhou J Q. Carbon market, internal control and carbon information quality: an empirical study based on Chinese A-share electric power enterprises[J]. Friends of Accounting, 2022 (2): 65-69 (in Chinese) | |

| [16] | 陈宁, 孙飞. 国内外ESG体系发展比较和我国构建ESG体系的建议[J]. 发展研究, 2019 (3): 59-64. |

| Chen N, Sun F. Comparison of the development of ESG system at home and abroad and suggestions on the building of ESG system in China[J]. Development Research, 2019 (3): 59-64 (in Chinese) | |

| [17] | 陈华, 王海燕, 荆新. 中国企业碳信息披露: 内容界定、计量方法和现状研究[J]. 会计研究, 2013 (12): 18-23, 96. |

| Chen H, Wang H Y, Jing X. Study on content definition, measure methods and status of carbon information disclosure in Chinese enterprises[J]. Accounting Research, 2013 (12): 18-23, 96 (in Chinese) | |

| [18] | 马险峰, 王骏娴, 秦二娃. 上市公司的ESG信披制度[J]. 中国金融, 2016 (16): 33-34. |

| Ma X F, Wang J X, Qin E W. ESG information disclosure system of listed companies[J]. China Finance, 2016 (16): 33-34 (in Chinese) | |

| [19] | 王青云, 王建玲. 上市公司企业社会责任信息披露质量研究: 基于沪市2008—2009年年报的分析[J]. 当代经济科学, 2012, 34 (3): 74-80, 127. |

| Wang Q Y, Wang J L. A study on the quality of corporate social responsibility information disclosure of listed companies-based on 2008-2009 annual reports of companies listed in Shanghai stock exchange[J]. Modern Economic Science, 2012, 34 (3): 74-80, 127 (in Chinese) | |

| [20] | 张彩平, 肖序. 国际碳信息披露及其对我国的启示[J]. 财务与金融, 2010 (3): 77-80. |

| Zhang C P, Xiao X. International carbon disclosure project (CDP) and its enlightenment for China[J]. Accounting and Finance, 2010 (3): 77-80 (in Chinese) | |

| [21] | 马亚明, 马金娅, 胡春阳. 资本市场开放可以提高上市公司治理质量吗: 基于沪港通的渐进双重差分模型检验[J]. 广东财经大学学报, 2021, 36 (4): 81-95. |

| Ma Y M, Ma J Y, Hu C Y. Can capital market liberalization improve the governance quality of listed companies: the time-varying DID test based on Shanghai-Hong Kong Stock Connect[J]. Journal of Guangdong University of Finance & Economics, 2021, 36 (4): 81-95 (in Chinese) | |

| [22] | 连立帅, 朱松, 陈超. 资本市场开放与股价对企业投资的引导作用: 基于沪港通交易制度的经验证据[J]. 中国工业经济, 2019 (3): 100-118. |

| Lian L S, Zhu S, Chen C. Stock market liberalization and corporate investment sensitivity to stock price: evidence from Hong Kong-Shanghai Stock Connect[J]. China Industrial Economics, 2019 (3): 100-118 (in Chinese) | |

| [23] | 钟覃琳, 陆正飞. 资本市场开放能提高股价信息含量吗? 基于“沪港通”效应的实证检验[J]. 管理世界, 2018, 33 (1): 169-179. |

| Zhong Q L, Lu Z F. Can market liberalization improve the stock price informativeness? Evidence from Shanghai-Hong Kong Stock Connect[J]. Journal of Management World, 2018, 33 (1): 169-179 (in Chinese) | |

| [24] | 郭阳生, 沈烈, 郭枚香. 沪港通改善了上市公司信息环境吗? 基于分析师关注度的视角[J]. 证券市场导报, 2018 (10): 33-35, 50. |

| Guo Y S, Shen L, Guo M X. Has the Shanghai and Hong Kong Stock Connect improved the information environment of listed companies?[J]. Securities Market Herald, 2018 (10): 33-35, 50 (in Chinese) | |

| [25] | 唐建新, 程利敏, 陈冬. 资本市场开放与自愿性信息披露: 基于沪港通和深港通的实验检验[J]. 经济理论与经济管理, 2021, 41 (2): 85-97. |

| Tang J X, Cheng L M, Chen D. Stock market liberalization and voluntary information disclosure: tests based on the Shanghai/ Shenzhen-Hong Kong Stock Connect program[J]. Economic Theory and Business Management, 2021, 41 (2): 85-97 (in Chinese) | |

| [26] | 阮睿, 孙宇辰, 唐悦, 等. 资本市场开放能否提高企业信息披露质量?基于“沪港通”和年报文本挖掘的分析[J]. 金融研究, 2021 (2): 188-206. |

| Ruan R, Sun Y C, Tang Y, et al. Can opening the capital market improve the quality of corporate information disclosure? An analysis based on the Shanghai-Hong Kong Stock Connect and annual report texts[J]. Journal of Financial Research, 2021 (2): 188-206 (in Chinese) | |

| [27] | 李沁洋, 石玉阶. 资本市场开放对公司信息披露质量的影响研究: 基于沪深港通机制的证据[J]. 当代金融研究, 2022, 5 (7): 51-69. |

| Li Q Y, Shi Y J. The impact of capital market opening on the quality of corporate information disclosure: the evidence from the Shanghai-Hong Kong and the Shenzhen-Hong Kong Stock Connect[J]. Journal of Contemporary Financial Research, 2022, 5 (7): 51-69 (in Chinese) | |

| [28] | 张俊瑞, 仇萌, 张志超, 等. “深港通”与前瞻性信息披露: 基于上市公司年报语言将来时态特征的研究[J]. 证券市场导报, 2022 (4): 15-26. |

| Zhang J R, Qiu M, Zhang Z C, et al. Shenzhen-Hong Kong Stock Connect program and forward-looking information disclosure: a study based on the future tense characteristics of listed companies’ annual report language[J]. Securities Market Herald, 2022 (4): 15-26 (in Chinese) | |

| [29] | 李小林, 刘冬, 葛新宇, 等. 中国资本市场开放能否降低企业风险承担?来自“沪深港通”交易制度的经验证据[J]. 国际金融研究, 2022 (7): 77-86. |

| Li X L, Liu D, Ge X Y, et al. Does capital market openness lower firm risk-taking in China? Evidence from Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect[J]. Studies of International Finance, 2022 (7): 77-86 (in Chinese) | |

| [30] | 黄国良, 余娟. 资本市场开放与信息披露质量: 基于“深港通”实证检验[J]. 会计之友, 2022 (2): 21-28. |

| Huang G L, Yu J. Capital market opening and quality of information disclosure: an empirical test based on Shenzhen-Hong Kong Stock Connect[J]. Friends of Accounting, 2022 (2): 21-28 (in Chinese) | |

| [31] | 杜建华, 刘陈杨. 资本市场开放与企业社会责任: 基于“陆港通”的准自然实验证据[J]. 会计之友, 2022 (16): 109-118. |

| Du J H, Liu C Y. Capital market opening and corporate social responsibility: quasi natural experimental evidence based on the Inland-Hong Kong Stock Connect[J]. Friends of Accounting, 2022 (16): 109-118 (in Chinese) | |

| [32] | 王婉菁, 朱红兵, 张兵. 资本市场开放与环境信息披露质量[J]. 管理科学, 2021, 34 (6): 29-42. |

| Wang W J, Zhu H B, Zhang B. Capital market liberalization and quality of environment information disclosure[J]. Journal of Management Science, 2021, 34 (6): 29-42 (in Chinese) |

| No related articles found! |

| Viewed | ||||||

|

Full text |

|

|||||

|

Abstract |

|

|||||