气候变化研究进展 ›› 2023, Vol. 19 ›› Issue (2): 227-237.doi: 10.12006/j.issn.1673-1719.2022.156

碳信息披露与资本市场开放——基于沪港通与深港通的实践检验

- 中国人民大学环境学院,北京 100872

-

收稿日期:2022-06-28修回日期:2022-11-05出版日期:2023-03-30发布日期:2022-12-09 -

作者简介:许光清,女,副教授,gqingxu@126.com -

基金资助:国家电网公司总部管理科技项目(1400-202224242A-1-1-ZN)

Carbon information disclosure and capital market opening—a practical test based on Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect

- School of Environment and Natural Resources, Renmin University of China, Beijing 100872, China

-

Received:2022-06-28Revised:2022-11-05Online:2023-03-30Published:2022-12-09

摘要:

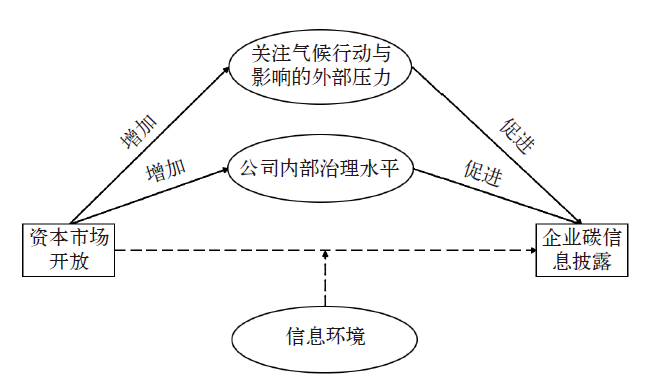

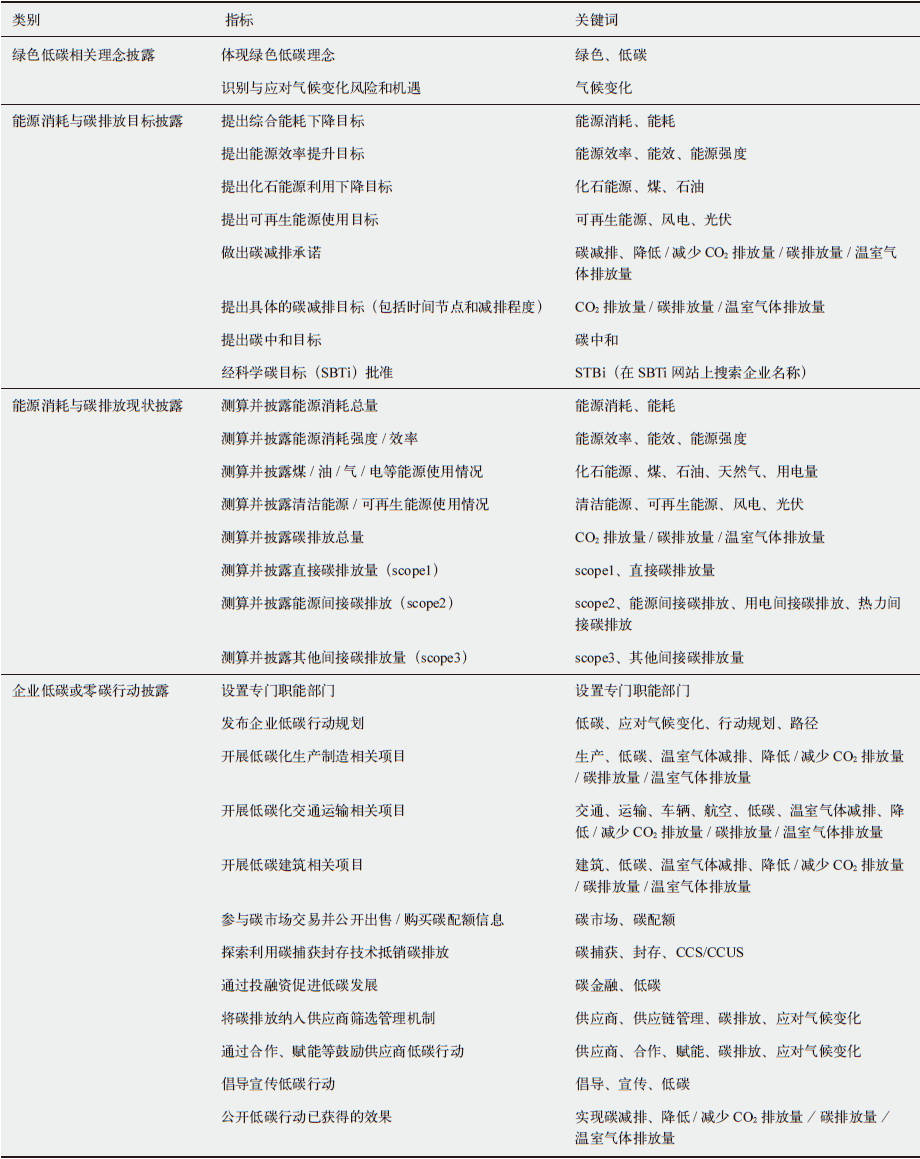

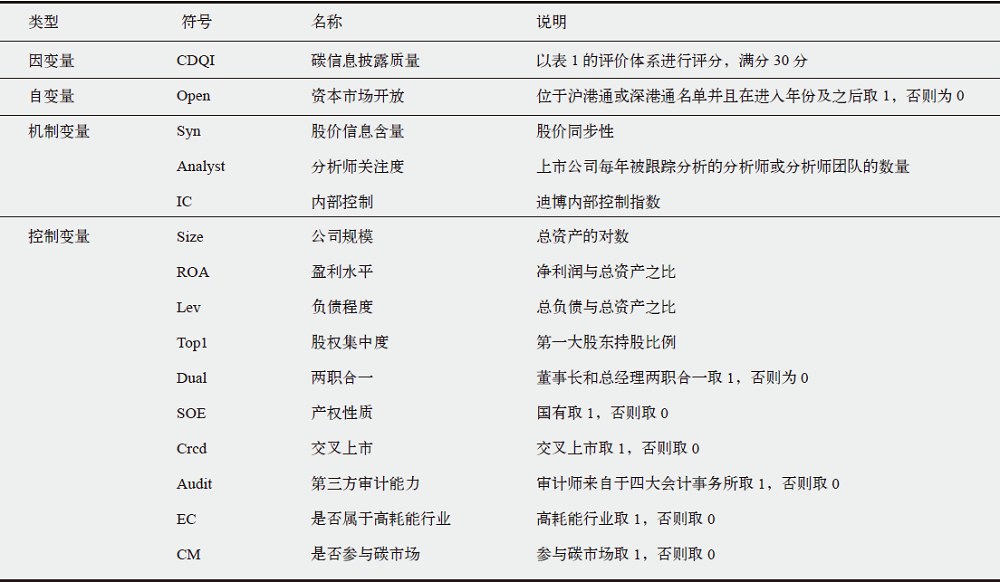

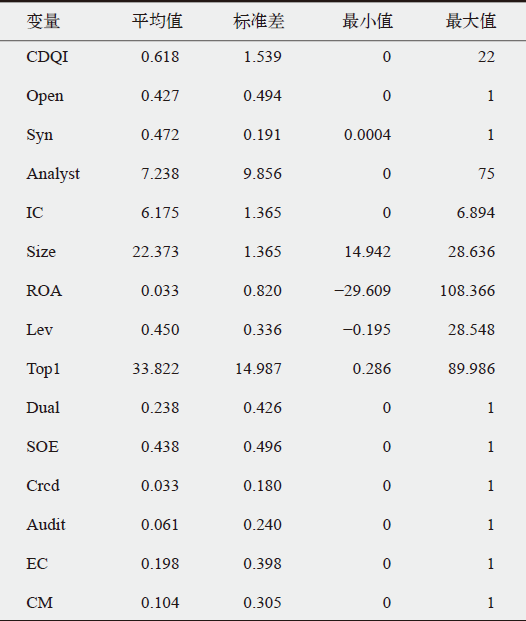

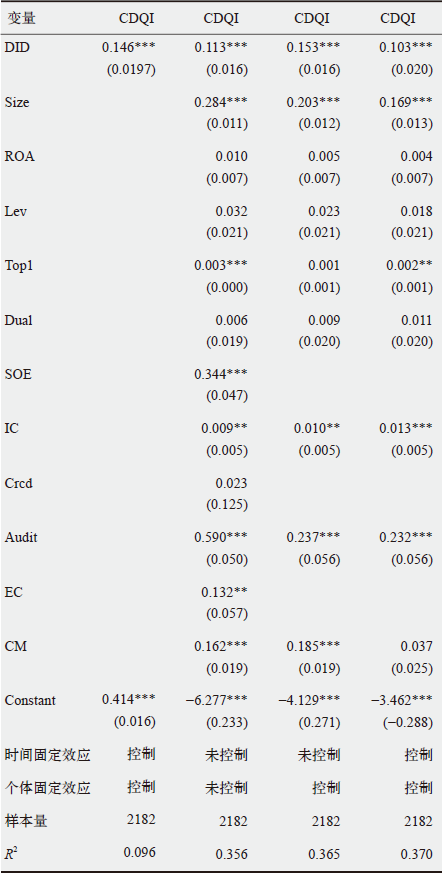

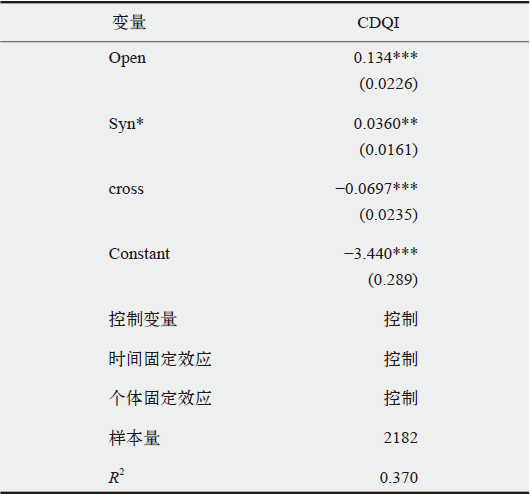

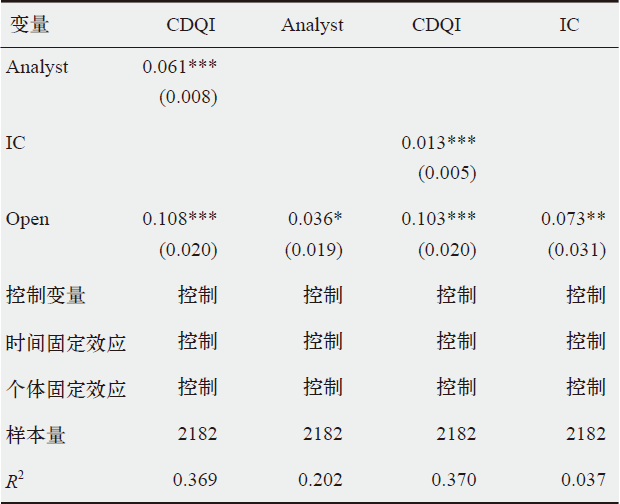

在实现“双碳”目标的背景下,企业碳信息披露是充分发挥市场机制和社会监督作用的基础。文中研究资本市场开放对企业碳信息披露的影响,并进一步分析碳信息披露的影响因素和作用机制。以沪港通和深港通为背景,以2012—2020年我国2182家A股上市企业数据为样本,构建多维度碳信息披露质量评价体系,运用多期倍分法(DID)模型进行分析。实证结果表明:资本市场开放对于企业碳信息披露有正向促进作用。信息环境对该促进作用有调节效应。外部压力和内部激励两方面的共同作用促成了企业在资本市场开放的背景下更好地披露碳信息。最后提出将对碳信息披露的促进作用纳入资本市场开放的考量、培养应对气候变化导向的资本市场、完善我国碳信息披露框架、努力改善公司治理方式并提高公司治理能力等政策建议。

引用本文

许光清, 吴静怡. 碳信息披露与资本市场开放——基于沪港通与深港通的实践检验[J]. 气候变化研究进展, 2023, 19(2): 227-237.

XU Guang-Qing, WU Jing-Yi. Carbon information disclosure and capital market opening—a practical test based on Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect[J]. Climate Change Research, 2023, 19(2): 227-237.

| [1] | 张宁, 庞军. 全国碳市场引入CCER交易及抵销机制的经济影响研究[J]. 气候变化研究进展, 2022, 18 (5): 622-636. |

| Zhang N, Pang J. The economic impacts of introducing CCER trading and offset mechanism into the national carbon market of China[J]. Climate Change Research, 2022, 18 (5): 622-636 (in Chinese) | |

| [2] | 谭德明, 邹树梁. 碳信息披露国际发展现状及我国碳信息披露框架的构建[J]. 统计与决策, 2010 (11): 126-128. |

| Tan D M, Zou S L. The international development status of carbon information disclosure and the construction of China’s carbon information disclosure framework[J]. Statistics & Decision, 2010 (11): 126-128 (in Chinese) | |

| [3] |

He Y, Tang Q, Wang K. Carbon disclosure, carbon performance, and cost of capital[J]. China Journal of Accounting Studies, 2013, 1 (3): 190-220

doi: 10.1080/21697221.2014.855976 URL |

| [4] | 蒋琰. 碳信息披露研究[M]. 南京: 南京大学出版社, 2017. |

| Jiang Y. Research on carbon disclosure[M]. Nanjing: Nanjing University Press, 2017 (in Chinese) | |

| [5] | Luo L, Lan Y C, Tang Q L. Corporate incentives to disclose carbon information: evidence from the CDP global 500 report[J]. Journal of International Financial Management & Accounting, 2012, 23 (2): 93-120 |

| [6] |

Tang Q, Luo L. Transparency of corporate carbon disclosure: international evidence[J]. Ssrn Electronic Journal, 2011. DOI: 10.2139/ssrn.1885230

doi: 10.2139/ssrn.1885230 |

| [7] | 陈华, 王海燕, 陈智. 公司特征与碳信息自愿性披露: 基于合法性理论的分析视角[J]. 会计与经济研究, 2013, 27 (4): 30-42. |

| Chen H, Wang H Y, Chen Z. Corporate characteristics and voluntary carbon disclosure: a perspective of legitimacy theory[J]. Accounting and Economics Research, 2013, 27 (4): 30-42 (in Chinese) | |

| [8] | 闫海洲, 陈百助. 气候变化、环境规制与公司碳排放信息披露的价值[J]. 金融研究, 2017 (6): 142-158. |

| Yan H Z, Chen B Z. Climate change, environment regulation and the firm value of carbon emissions disclosure[J]. Journal of Financial Research, 2017 (6): 142-158 (in Chinese) | |

| [9] | 董淑兰, 邹安妮, 刘芮萌. 社会信任、碳信息披露与企业绩效的关系研究: 基于中国城市商业信用CEI指数[J]. 会计之友, 2018 (21): 73-78. |

| Dong S L, Zou A N, Liu R M. Research on the relationship between social trust, carbon information disclosure and enterprise performance[J]. Friends of Accounting, 2018 (21): 73-78 (in Chinese) | |

| [10] | 宫宁, 段茂盛. 企业碳信息披露的动机与影响因素: 基于上证社会责任指数成分股企业的分析[J]. 环境经济研究, 2021, 6 (1): 31-52. |

| Gong N, Duan M S. The motivation and influencing factors of corporate carbon information disclosure: an analysis of the constituent enterprises of SSE social responsibility index[J]. Journal of Environmental Economics, 2021, 6 (1): 31-52 (in Chinese) | |

| [11] | 王朕. 企业自愿性碳信息披露机理与因素研究[J]. 商业会计, 2021 (15): 43-47. |

| Wang Z. Research on the mechanism and factors of voluntary carbon information disclosure in enterprises[J]. Commercial Accounting, 2021 (15): 43-47 (in Chinese) | |

| [12] | 李力, 刘全齐, 唐登莉. 碳绩效、碳信息披露质量与股权融资成本[J]. 管理评论, 2019, 31 (1): 221-235. |

| Li L, Liu Q Q, Tang D L. Carbon performance, carbon information disclosure quality and cost of equity financing[J]. Management Review, 2019, 31 (1): 221-235 (in Chinese) | |

| [13] | 崔秀梅, 李心合, 唐勇军. 社会压力、碳信息披露透明度与权益资本成本[J]. 当代财经, 2016 (11): 117-129. |

| Cui X M, Li X H, Tang Y J. Social pressure, transparency of carbon information disclosure and cost of equity capital[J]. Contemporary Finance & Economics, 2016 (11): 117-129 (in Chinese) | |

| [14] | 陈华, 刘婷, 张艳秋. 公司特征、内部治理与碳信息自愿性披露: 基于合法性理论的分析视角[J]. 生态经济, 2016, 32 (9): 52-58. |

| Chen H, Liu T, Zhang Y Q. Corporate characteristics, internal governance and carbon information voluntary disclosure: from the perspective of legitimacy theory[J]. Ecological Economy, 2016, 32 (9): 52-58 (in Chinese) | |

| [15] | 谈多娇, 王丹, 周家齐. 碳市场、内部控制和碳信息质量: 基于中国A股电力企业的实证研究[J]. 会计之友, 2022 (2): 65-69. |

| Tan D J, Wang D, Zhou J Q. Carbon market, internal control and carbon information quality: an empirical study based on Chinese A-share electric power enterprises[J]. Friends of Accounting, 2022 (2): 65-69 (in Chinese) | |

| [16] | 陈宁, 孙飞. 国内外ESG体系发展比较和我国构建ESG体系的建议[J]. 发展研究, 2019 (3): 59-64. |

| Chen N, Sun F. Comparison of the development of ESG system at home and abroad and suggestions on the building of ESG system in China[J]. Development Research, 2019 (3): 59-64 (in Chinese) | |

| [17] | 陈华, 王海燕, 荆新. 中国企业碳信息披露: 内容界定、计量方法和现状研究[J]. 会计研究, 2013 (12): 18-23, 96. |

| Chen H, Wang H Y, Jing X. Study on content definition, measure methods and status of carbon information disclosure in Chinese enterprises[J]. Accounting Research, 2013 (12): 18-23, 96 (in Chinese) | |

| [18] | 马险峰, 王骏娴, 秦二娃. 上市公司的ESG信披制度[J]. 中国金融, 2016 (16): 33-34. |

| Ma X F, Wang J X, Qin E W. ESG information disclosure system of listed companies[J]. China Finance, 2016 (16): 33-34 (in Chinese) | |

| [19] | 王青云, 王建玲. 上市公司企业社会责任信息披露质量研究: 基于沪市2008—2009年年报的分析[J]. 当代经济科学, 2012, 34 (3): 74-80, 127. |

| Wang Q Y, Wang J L. A study on the quality of corporate social responsibility information disclosure of listed companies-based on 2008-2009 annual reports of companies listed in Shanghai stock exchange[J]. Modern Economic Science, 2012, 34 (3): 74-80, 127 (in Chinese) | |

| [20] | 张彩平, 肖序. 国际碳信息披露及其对我国的启示[J]. 财务与金融, 2010 (3): 77-80. |

| Zhang C P, Xiao X. International carbon disclosure project (CDP) and its enlightenment for China[J]. Accounting and Finance, 2010 (3): 77-80 (in Chinese) | |

| [21] | 马亚明, 马金娅, 胡春阳. 资本市场开放可以提高上市公司治理质量吗: 基于沪港通的渐进双重差分模型检验[J]. 广东财经大学学报, 2021, 36 (4): 81-95. |

| Ma Y M, Ma J Y, Hu C Y. Can capital market liberalization improve the governance quality of listed companies: the time-varying DID test based on Shanghai-Hong Kong Stock Connect[J]. Journal of Guangdong University of Finance & Economics, 2021, 36 (4): 81-95 (in Chinese) | |

| [22] | 连立帅, 朱松, 陈超. 资本市场开放与股价对企业投资的引导作用: 基于沪港通交易制度的经验证据[J]. 中国工业经济, 2019 (3): 100-118. |

| Lian L S, Zhu S, Chen C. Stock market liberalization and corporate investment sensitivity to stock price: evidence from Hong Kong-Shanghai Stock Connect[J]. China Industrial Economics, 2019 (3): 100-118 (in Chinese) | |

| [23] | 钟覃琳, 陆正飞. 资本市场开放能提高股价信息含量吗? 基于“沪港通”效应的实证检验[J]. 管理世界, 2018, 33 (1): 169-179. |

| Zhong Q L, Lu Z F. Can market liberalization improve the stock price informativeness? Evidence from Shanghai-Hong Kong Stock Connect[J]. Journal of Management World, 2018, 33 (1): 169-179 (in Chinese) | |

| [24] | 郭阳生, 沈烈, 郭枚香. 沪港通改善了上市公司信息环境吗? 基于分析师关注度的视角[J]. 证券市场导报, 2018 (10): 33-35, 50. |

| Guo Y S, Shen L, Guo M X. Has the Shanghai and Hong Kong Stock Connect improved the information environment of listed companies?[J]. Securities Market Herald, 2018 (10): 33-35, 50 (in Chinese) | |

| [25] | 唐建新, 程利敏, 陈冬. 资本市场开放与自愿性信息披露: 基于沪港通和深港通的实验检验[J]. 经济理论与经济管理, 2021, 41 (2): 85-97. |

| Tang J X, Cheng L M, Chen D. Stock market liberalization and voluntary information disclosure: tests based on the Shanghai/ Shenzhen-Hong Kong Stock Connect program[J]. Economic Theory and Business Management, 2021, 41 (2): 85-97 (in Chinese) | |

| [26] | 阮睿, 孙宇辰, 唐悦, 等. 资本市场开放能否提高企业信息披露质量?基于“沪港通”和年报文本挖掘的分析[J]. 金融研究, 2021 (2): 188-206. |

| Ruan R, Sun Y C, Tang Y, et al. Can opening the capital market improve the quality of corporate information disclosure? An analysis based on the Shanghai-Hong Kong Stock Connect and annual report texts[J]. Journal of Financial Research, 2021 (2): 188-206 (in Chinese) | |

| [27] | 李沁洋, 石玉阶. 资本市场开放对公司信息披露质量的影响研究: 基于沪深港通机制的证据[J]. 当代金融研究, 2022, 5 (7): 51-69. |

| Li Q Y, Shi Y J. The impact of capital market opening on the quality of corporate information disclosure: the evidence from the Shanghai-Hong Kong and the Shenzhen-Hong Kong Stock Connect[J]. Journal of Contemporary Financial Research, 2022, 5 (7): 51-69 (in Chinese) | |

| [28] | 张俊瑞, 仇萌, 张志超, 等. “深港通”与前瞻性信息披露: 基于上市公司年报语言将来时态特征的研究[J]. 证券市场导报, 2022 (4): 15-26. |

| Zhang J R, Qiu M, Zhang Z C, et al. Shenzhen-Hong Kong Stock Connect program and forward-looking information disclosure: a study based on the future tense characteristics of listed companies’ annual report language[J]. Securities Market Herald, 2022 (4): 15-26 (in Chinese) | |

| [29] | 李小林, 刘冬, 葛新宇, 等. 中国资本市场开放能否降低企业风险承担?来自“沪深港通”交易制度的经验证据[J]. 国际金融研究, 2022 (7): 77-86. |

| Li X L, Liu D, Ge X Y, et al. Does capital market openness lower firm risk-taking in China? Evidence from Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect[J]. Studies of International Finance, 2022 (7): 77-86 (in Chinese) | |

| [30] | 黄国良, 余娟. 资本市场开放与信息披露质量: 基于“深港通”实证检验[J]. 会计之友, 2022 (2): 21-28. |

| Huang G L, Yu J. Capital market opening and quality of information disclosure: an empirical test based on Shenzhen-Hong Kong Stock Connect[J]. Friends of Accounting, 2022 (2): 21-28 (in Chinese) | |

| [31] | 杜建华, 刘陈杨. 资本市场开放与企业社会责任: 基于“陆港通”的准自然实验证据[J]. 会计之友, 2022 (16): 109-118. |

| Du J H, Liu C Y. Capital market opening and corporate social responsibility: quasi natural experimental evidence based on the Inland-Hong Kong Stock Connect[J]. Friends of Accounting, 2022 (16): 109-118 (in Chinese) | |

| [32] | 王婉菁, 朱红兵, 张兵. 资本市场开放与环境信息披露质量[J]. 管理科学, 2021, 34 (6): 29-42. |

| Wang W J, Zhu H B, Zhang B. Capital market liberalization and quality of environment information disclosure[J]. Journal of Management Science, 2021, 34 (6): 29-42 (in Chinese) |

| No related articles found! |

| 阅读次数 | ||||||

|

全文 |

|

|||||

|

摘要 |

|

|||||